Now Available!

Returning Users:

- Use your existing username (account number)

- Select “Forgot Password” to re-register

- Complete the verification screen with the primary account holder’s information.

- For additional assistance, please email cvcu@capview.com

For details about this conversion, download the member conversion guide, here.

New Users:

- Select “New User Registration”

- Complete the verification screen with the primary account holder’s information.

- For additional assistance, please email cvcu@capview.com

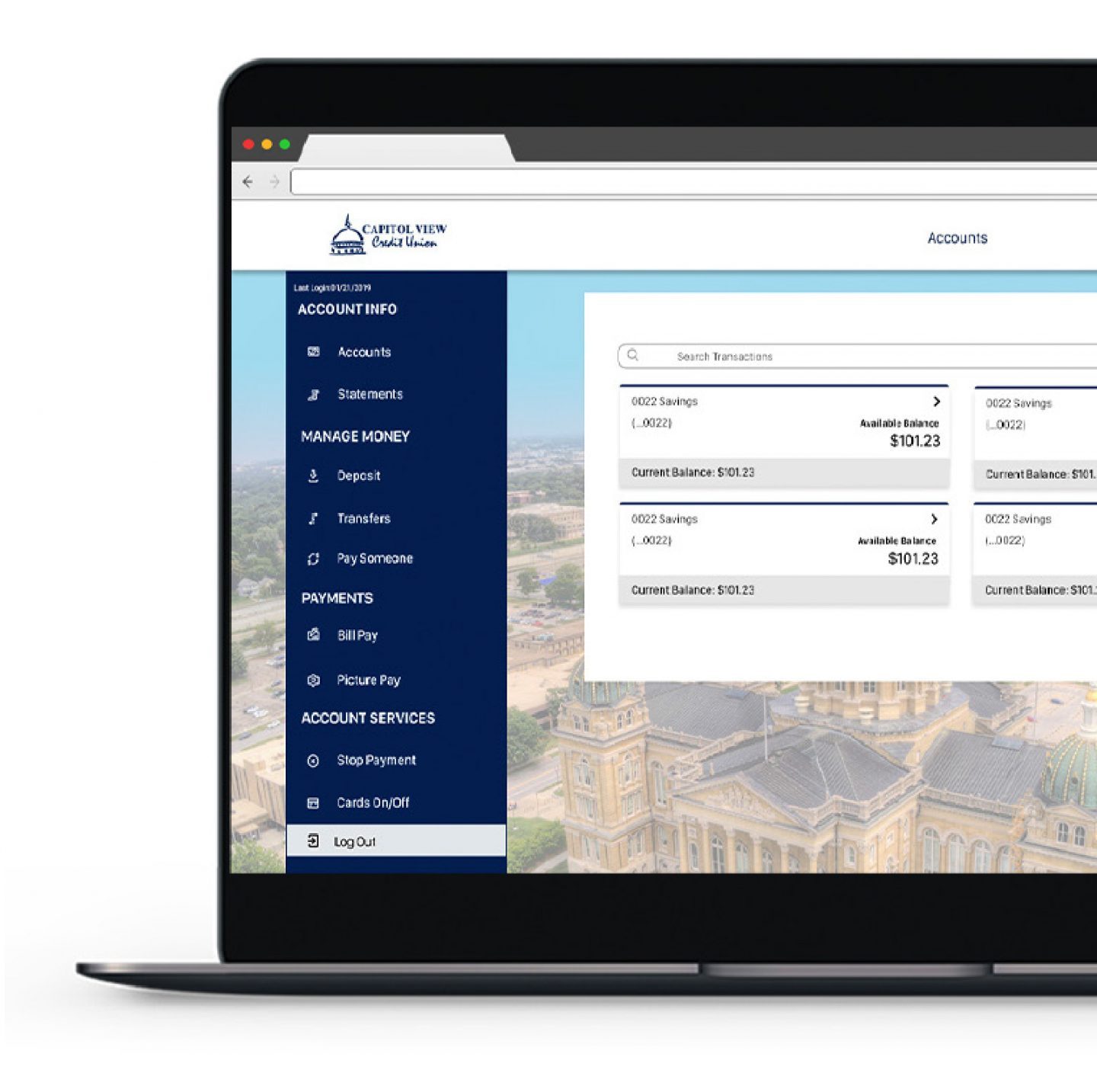

Digital Banking

Capitol View’s digital banking platform offers the robust, modern banking solutions you might expect from a large, national institution. Digital banking is available across desktop, mobile, and tablet devices and allows members to view balances, track history, download eStatements, transfer funds, make loan and credit card payments, setup account alerts, access bill pay services, access Capview360 and more!

Capitol View’s digital banking platform offers the robust, modern banking solutions you might expect from a large, national institution. Digital banking is available across desktop, mobile, and tablet devices and allows members to view balances, track history, download eStatements, transfer funds, make loan and credit card payments, setup account alerts, access bill pay services, access Capview360 and more!

View Digital Banking Agreement and Disclosures

Here are some highlights of our digital banking platform:

What’s New

|

Face ID and Touch ID – Convenient, secure login for compatible Apple products |

|

Block/Unblock Debit Cards – Block/unblock your debit cards in real-time |

|

New Secure Login Method – No captcha code or security questions required |

|

Mobile Check Deposit – Now available on desktop computers |

|

Streamlined Bill Pay Service – Including e-bills, picture-pay, and custom notifications |

|

Account-to-Account (A2A) Transfers – Brand new A2A transfer tool connecting all your accounts |

|

Person-to-Person (P2P) Transfers – Same-day funds availability when payee uses their debit card |

|

Capview 360 – Track, budget, and categorize activity from your other institutions for a 360-view of your finances |

Mobile Application

Capitol View’s mobile application is a powerful on-the-go tool to manage your accounts. With our mobile app, members can access all of the same robust digital banking tools available from a desktop computer.

Capitol View’s mobile application is a powerful on-the-go tool to manage your accounts. With our mobile app, members can access all of the same robust digital banking tools available from a desktop computer.

Our app is available on Apple and Android smartphones and tablets.

Mobile Check Deposit

Easily deposit checks using your smartphone, tablet, or desktop computer with digital banking. Mobile deposit funds are available on the second business day following your deposit. Be sure to retain the original check for 30 days.

Easily deposit checks using your smartphone, tablet, or desktop computer with digital banking. Mobile deposit funds are available on the second business day following your deposit. Be sure to retain the original check for 30 days.

Bill Pay / A2A / P2P

Moving money is made simple across our bill pay, A2A, and P2P tools. Link and pay your bills with ease in our convenient bill pay system. Our A2A tool allows you to link to third party institutions and transfer funds between them and your Capitol View account. You can also send money directly to individuals using our P2P transfer tool.

Capview 360

With Capview360, you can track and categorize transactions across all of your accounts at various institutions, giving you a 360 degree view of your finances. Create budgets, savings goals, and manage your net worth all within this powerful tool. Select “Capview 360” in the main menu of digital banking to get started. Learn more here!

” width=”20″ height=”20″>