Home values are on the rise and rates will be, soon.

Now is the perfect time to capitalize on your home’s equity before rates rise.

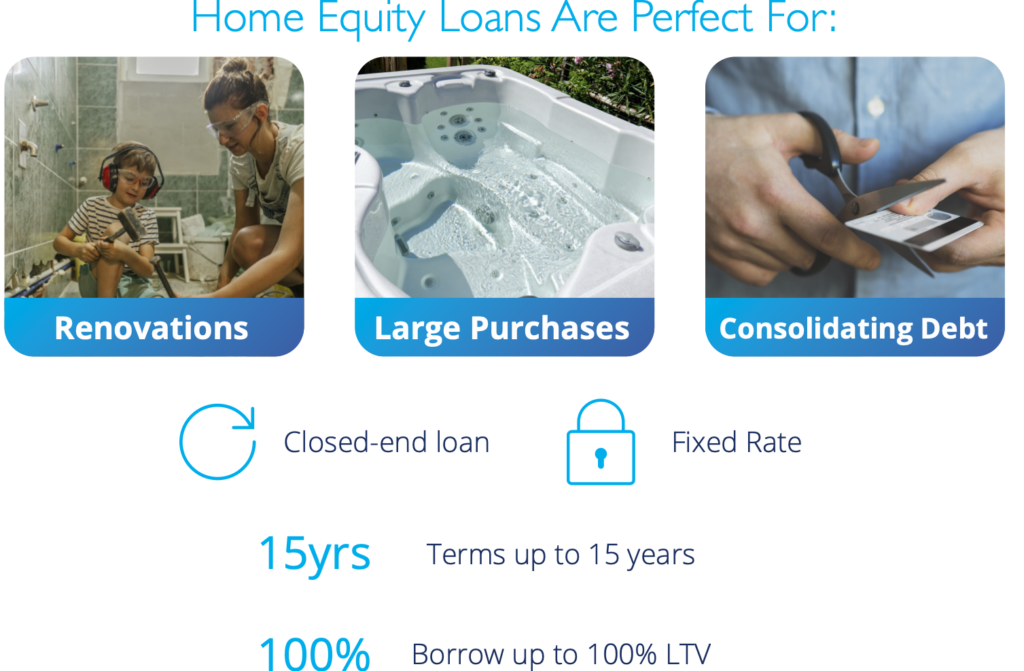

Home equity loans are a great way to finance large projects or purchases. Whether building an addition, remodeling, education expenses, or consolidating debt a home equity loan will offer a low, fixed rate for anything you put your mind to. By using your home’s value as collateral (up to 100% loan-to-value), you will be able to secure a low, fixed rate loan for whatever your needs are.

Let Us Explore Your Options!

Contact Linda or Diane at caploan@capview.com

or call 515-348-8350, option 3.

|

|

| Home Equity Loan (Fixed Rate) | ||

| Term | Regular Rate | Loyalty Rate* |

| 60 Months – 85% LTV | 7.24% | 6.99% |

| 120 Months – 85% LTV | 7.74% | 7.49% |

| 180 Months – 60% LTV | 7.74% | 7.49% |

| 180 Months – 85% LTV | 8.24% | 7.99% |

| LTV = “Loan-To-Value” Ratio Add 2% for LTV above 85% |

||

| Rates are as of March 15, 2024 and are subject to change. APR = Annual Percentage Rate. All rates listed are our best rates and may vary based on creditworthiness and other factors. Capitol View uses TransUnion for credit reporting information. To view a copy of your credit report visit www.annualcreditreport.com |

*Loyalty Rates:

Members who enroll in direct deposit of their full paycheck and a setup automatic payments for their loan qualify for a 0.25% rate discount on that loan. This discount cannot be combined with other rate discounts.